Supermarket, convenience-store and fast-food chains now dominate the global food supply—and our waistlines are feeling the impact. A new Nature Food study that followed retail trends in ninety-seven countries between 2009 and 2023 reveals a tight link between the rapid expansion of corporate food retailers, booming sales of ultra-processed products and a simultaneous surge in obesity around the world.

The authors warn that while mega-chains have made food more accessible and affordable, they have also created “obesogenic” environments in which genuinely healthy choices are the hardest to make.

The Global Food Landscape Transformed

In just over a decade the way people buy food has shifted dramatically, away from traditional markets and family-run grocers toward sprawling supermarkets, 24-hour convenience stores and fast-food franchises.

South Asia illustrates the pace of change: the region recorded a 275 percent jump in chain-store density between 2009 and 2023, mirroring trajectories observed across Latin America, sub-Saharan Africa and much of Europe. Large chains undeniably bring convenience and lower shelf prices, yet they also flood local neighbourhoods with ultra-processed, calorie-dense items that are high in sugar, salt and saturated fat while providing little fibre or essential micronutrients.

Unlike fresh produce or staple grains, these packaged foods are engineered for maximum palatability, portability and shelf-life. Their bright wrappers, price promotions and strategic eye-level placement crowd out healthier options and steer consumers toward ready-to-eat snacks, sweetened beverages and instant meals.

Over time those products contribute to higher daily energy intake and push population risk for obesity, type 2 diabetes and cardiovascular disease ever upward.

The Rise of Extreme Obesity (BMI ≥60 kg/m²): A Public Health Crisis in the Making

– – –

🚨 New data from NHANES shows an alarming trend:The prevalence of BMI ≥60 kg/m² has tripled over the past two decades — from 0.12% (2001–04) to 0.37% (2021–23).

These individuals face… pic.twitter.com/KnkknhJ1H1

— Michael “Mike” Albert, MD (@MichaelAlbertMD) April 26, 2025

What the Numbers Say

The headline figures from the Nature Food paper are striking. Globally, the density of chain food outlets—including supermarkets, convenience stores and fast-food franchises—jumped from 2.63 to 3.25 per ten-thousand residents, a 23.6 percent increase. Low- and middle-income countries logged the fastest acceleration, particularly in the early study years, whereas growth in many high-income nations flattened after 2018.

The flip side of that expansion was the retreat of independent retailers. Over the same period the number of small, non-chain outlets shrank by 13.7 percent, stripping many communities of walkable access to fresh, minimally processed foods. When researchers calculated the ratio of local shops to big-box competitors, they found it had collapsed by 61 percent worldwide—a seismic restructuring of the everyday food environment.

Sales data reinforced the structural picture. Purchases of sugary drinks, salty snacks and other ultra-processed items grew on average 4.9 percent across the globe. In North America more than four-fifths of all junk-food transactions now occur inside chain stores, while South Asia, despite starting at a lower base, recorded the steepest year-on-year growth.

Meanwhile, online grocery services took off—especially in upper-middle-income economies—delivering high-calorie convenience directly to front doors. The study’s authors describe e-commerce as “a new frontier” through which Big Food is reshaping diets even faster than bricks-and-mortar outlets once did.

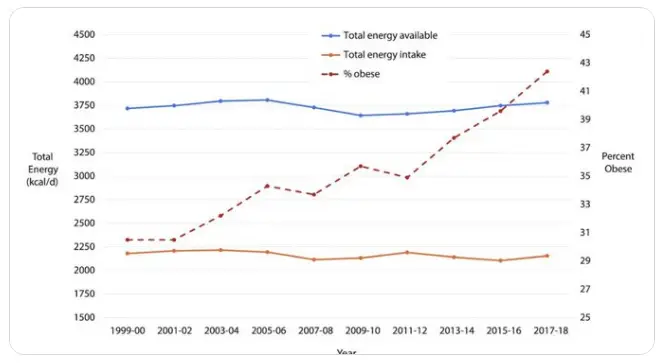

This chart should terrify you

Obesity rates are up 30% in the last 20 years even though total caloric consumption hasn’t changed.

Something is poisoning our metabolism and causing us to gain weight. pic.twitter.com/O66R7p7MX1

— Carnivore Aurelius ©🥩 ☀️🦙 (@AlpacaAurelius) June 26, 2024

An Alarming Link to Obesity

The public-health stakes are stark. Countries with the deepest penetration of corporate retailers and the greatest household expenditure on ultra-processed foods also registered the largest gains in adult and childhood obesity.

Between 2009 and 2022 global obesity prevalence climbed roughly two percentage points, but the rise was steeper wherever chain grocers and fast-food brands dominated. Even in North America—where the food environment was already heavily corporatised at the start of the observation window—obesity continued its upward march, suggesting that once a market is saturated with cheap, energy-dense fare, reversing momentum becomes extraordinarily difficult.

Not every region followed exactly the same retail trajectory, yet the outcome was similar. The study noted that sub-Saharan Africa saw fewer large-chain openings than other parts of the world, while North America experienced only modest additional growth due to its already mature supermarket sector. Nevertheless, both areas recorded measurable upticks in average body-mass index, underlining that diet quality—not merely outlet count—is the decisive factor.

What Can Be Done?

Public-health advocates contend that the latest evidence makes a compelling case for urgent policy intervention. One proposed lever is fiscal: governments could create targeted tax incentives for retailers that dedicate prime shelf space to fresh fruit, vegetables and whole-grain staples, or that pass bulk-buy savings on wholesome items directly to shoppers instead of using them solely to discount confectionery and soda.

Urban-planning levers matter too. Several cities are experimenting with zoning rules that cap fast-food density around schools and in low-income neighbourhoods, reducing the omnipresence of supersized portions and value-meal marketing to young consumers. Front-of-pack labelling and stricter controls on in-store placement of high-sugar products have also shown promise, nudging shoppers toward healthier baskets without eliminating choice.

On the corporate side, the emerging UNICEF Guidance Framework calls on supermarkets to adopt nutrition standards that make healthier options visible, affordable and appealing to children. Public-health expert Jane Martin, in the tweet embedded above, urges Australian chains like Woolworths and Coles to lead by example. Supermarkets could, for instance, switch checkout aisles from confectionery to fruit snacks and nuts, run loyalty-card rewards that favour produce purchases or highlight local growers to re-energise short supply chains.

Governments meanwhile must keep an eye on market concentration. As global food retail consolidates further, a handful of conglomerates will wield unprecedented influence over what the world eats. Vigilant antitrust enforcement, mandatory reporting of nutrition metrics and limits on junk-food marketing to children are all tools regulators can deploy. Researchers stress that delayed action simply shifts today’s retail convenience into tomorrow’s healthcare costs.

For ordinary consumers the take-home message is clear: the modern convenience of one-stop grocery shopping and near-instant food delivery often carries hidden health costs. By choosing whole foods where possible, supporting local producers and advocating for stronger retail nutrition standards, individuals can help push the system in a healthier direction. But systemic change—making the healthy choice the truly easy and affordable one—will ultimately depend on coordinated efforts by policymakers, public-health experts and, crucially, the corporate giants that have reshaped the global food landscape.